Debt recovery for legal entities

Overdue invoices are a nuisance. To avoid getting into such a situation, which can lead to secondary insolvency and put your business at risk, you need to address them immediately.

What is debt recovery for legal entities

Out-of-court debt collection for legal entities is an administrative service whose task is to recover money from overdueunpaid invoices from your business partners (debtors) in the shortest possible time in such a way that your business relations do not deteriorate. The essence of our recovery is to keep your business relationships as good as they were before the recovery.

Early collection

Preventing bad debts from arising is cheaper and easier.

Find out more

Out-of-court debt recovery

After signing the contract and handing over your debtors, we immediately start the out-of-court recovery process.

Find out more

Judicial recovery

They say where there is a will, there is a way. However, if there is no will, the only solution is often legal debt recovery.

Find out more

Recovery of claims from abroad

We provide you with debt recovery from abroad through our international network.

Find out more

Are you interested? Request

free consultation with the proposal.

We will advise you on how to address your needs efficiently and functionally. At no unnecessary cost and of the highest quality.

We will get back to you as soon as possible.

How debt recovery works for legal entities

The priority in debt recovery for legal entities is to establish contact with the debtor. It is therefore ideal if we have all available contacts for the debtor. Immediately after sending the documents, we start the recovery process. We use all forms of communication in order to make the debt recovery as efficient as possible.

We use the following forms of communication to collect debts:

- correspondence by letter

- telephone contact of the debtor

- e-mail communication

- SMS

- personal communication

What you need to start recovery

Simple administrative steps are sufficient to get started:

- just send us the claims you would like to recover, ideally in a database in xlsx or similar format

- Based on this, we will prepare a tailor-made offer for you and a draft mandate agreement together with a power of attorney

- after acceptance of our offer and confirmation of the contract, cases can be delegated to us for recovery

- data exchange and the entire communication can be carried out electronically

The sooner the better – we have almost 100% success rate with younger claims

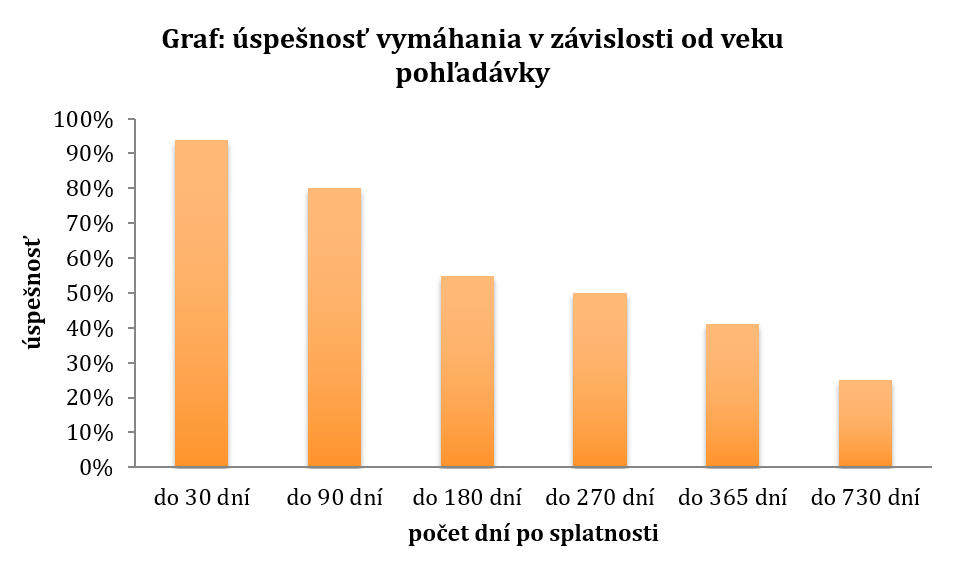

When to start debt recovery? The answer is very simple: the sooner the better. Why this is so is suggested by this chart. We recover debts within 30 days with almost 100% success rate.

As the chart shows, the earlier you start the debt recovery process, the more likely it is that the debt will actually be paid. There are several reasons why people and companies do not pay their debts. Here are the most common ones (beware, these are stated reasons, i.e. what the debtor claims may not be the real reasons):

- I don’t know of any debt – unless he is aware of his debt. This group is the best to work with.

- I don’t have the money to pay – this group is also quite easy to work with and we usually agree on a payment plan

- I have already paid it – the debtor claims that the debt has already been settled

- the debtor does not want to pay – he insists on principle that he does not have to pay

- you are unable to contact the debtor and inform him about his debt

Anyway, the Slovak saying is true: “First come, first served”. Therefore, the sooner you start insisting on paying your debts, the more likely you are to be successful.

Forms of debt recovery for legal entities

- Early collection

- Out-of-court debt recovery (soft collection)

- Judicial recovery (hard collection)

- Enforcement of debts

Who is this service for

The out-of-court debt collection service is intended for entrepreneurs. This means for companies and individuals – sole traders who have not been paid their invoices by their business partners by the due date.

Are you interested? Request

free consultation with the proposal.

We will advise you on how to address your needs efficiently and functionally. At no unnecessary cost and of the highest quality.

We will get back to you as soon as possible.

The advantages of outsourcing debt recovery are obvious

Out-of-court debt recovery is one of the fairest services. You only pay for what you actually collect based on our work. There are no initial administration fees, just a commission on the amount successfully recovered. The main advantages of debt recovery are described below:

- no initial fees, commission based on success only – our reward is only if we are successful

- third-party psychological effect – your debtor will realise that if you have decided to cooperate with us, you consider the situation to be serious

- global reach – we can recover debts also abroad

- your employees can devote themselves to the activities they are assigned to in the company – in particular, accountants only deal with unpaid invoices when they have time

- obtaining additional information about the debtor – in the course of the recovery, we will obtain information that may be important to you, either for further cooperation or for possible judicial and enforcement action

- regular reports with collection success – you have online access to the status of your receivables and regular monthly reports on the status of your receivables

Are you hesitant to use our services or have additional questions? Fill in the short form and we will get back to you.

Are you interested? Arrange a free consultation.

If you need advice or are interested in a quote, please fill out the form below. We will get back to you as soon as possible.

These companies trust us.

You can trust us too.

CONTACT US FOR A NO-OBLIGATION QUOTATION